Srinagar, September 6, 2025 : In a significant financial milestone, J&K Bank on Saturday presented a dividend of over ₹130 crore to the Union Territory Administration, marking the initiation of its shareholder dividend payments for the financial year 2024–25.

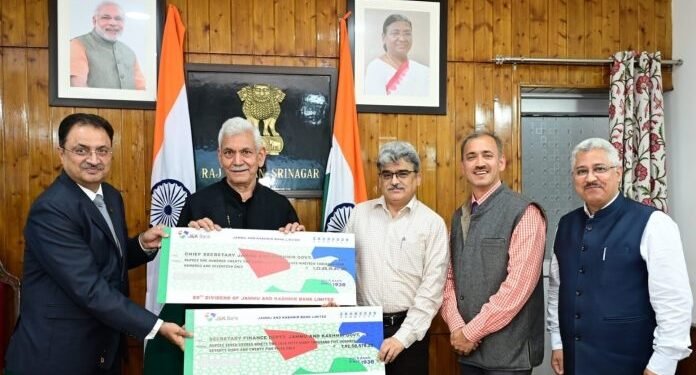

The Bank’s MD & CEO Amitava Chatterjee handed over two dividend cheques worth ₹122.85 crore and ₹7.92 crore respectively to Lieutenant Governor Manoj Sinha at the Raj Bhawan.

Present on the occasion were Chief Secretary Atal Dulloo, Principal Secretary Finance Santosh D. Vaidya, Principal Secretary to LG Dr. Mandeep K. Bhandari, and J&K Bank Company Secretary Mohammad Shafi Mir.

Strongest-Ever Financial Performance

The dividend payout follows the approval of a 215% dividend at the Bank’s 87th Annual General Meeting (AGM). Officials noted that the move reflects not just the bank’s solid balance sheet but also its critical role in supporting J&K’s economic growth and financial inclusion.

For the third consecutive year, J&K Bank has reported record earnings, capping FY 2024–25 with its highest-ever net profit of ₹2,082 crore.

The institution has scripted a remarkable turnaround:

-

2019–20: Reported a loss of ₹1,139 crore.

-

2023–24: Swung into profit with ₹1,700 crore earnings.

-

2024–25: Surpassed its own record with a historic ₹2,082 crore net profit.

LG’s Message: Growth With Inclusion

Congratulating the J&K Bank management and staff, Lieutenant Governor Manoj Sinha said the dividend reflects the institution’s resilience and resurgence. He urged the Bank to:

-

Expand financial inclusion by reaching out to the unbanked population.

-

Support small and micro-enterprises in both manufacturing and services.

-

Continue driving Mission YUVA, which seeks inclusive, equitable, and sustainable growth across the UT.

“The Bank has witnessed a complete turnaround since 2019. It must now channel its growth into empowering people and catalyzing economic opportunities,” the LG said.

J&K Bank’s Roadmap

Outlining the performance trajectory, MD & CEO Amitava Chatterjee reiterated the Bank’s commitment to “delivering world-class banking services while acting as a key driver of J&K’s socio-economic transformation.”

He emphasized that the Bank’s focus will remain on strengthening digital services, SME lending, and youth-oriented initiatives, positioning J&K Bank as both a profitable enterprise and a public growth partner.