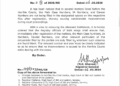

As the last date for filing the GST annual return for the financial year 2023-24 is December 31, GST-registered taxpayers will be required to submit it to consolidate their annual transactions.

For not filing a GST Annual Return (GSTR-9), a company, with a turnover up to Rs 5 crore, will have to pay a maximum penalty of Rs 50 per day (Rs 25 each under CGST and SGST) or 0.04 per cent of turnover.

A company with a turnover of Rs 5 crore to Rs 20 crore will have to pay a maximum penalty of Rs 100 per day (Rs 50 each under CGST and SGST), or 0.04 per cent of turnover. Similarly, a company with a turnover of over Rs 20 crore will have to pay a maximum penalty of Rs 200 per day (Rs 100 each under CGST and SGST), or 0.50 per cent of turnover.

A business with a turnover of more than Rs 2 crore will have to file GSTR-9.

GSTR-9A is for taxpayers under the GST composition scheme. GSTR-9C is for businesses with a turnover of more than Rs 5 crore. An additional annual reconciliation statement is required along with GSTR-9.

Businesses with multiple GST registrations under one PAN must file separate GSTR-9 returns for each GSTIN.

Taxpayers who file ITR after the deadline are fined Rs 5,000. For taxpayers with an income less than Rs 5 lakh, this penalty amount is Rs 1,000.